How We Do It

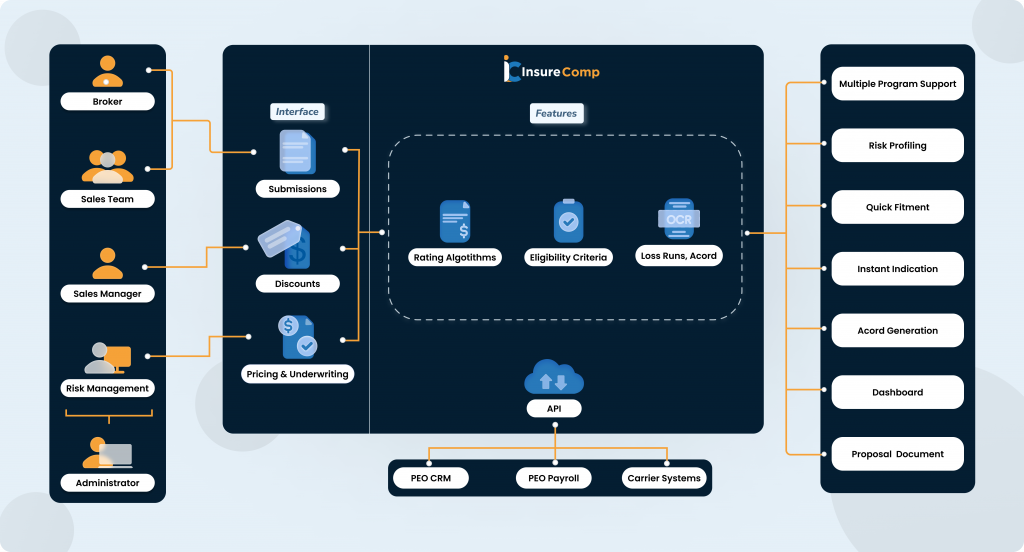

Multiple Interfaces

With a single platform for your sales, risk, underwriting, and pricing teams, this unified interface allows for streamlined collaboration and efficient decision-making across different functions, ultimately enhancing the overall insurance process.

Implementation Scenario

Sales teams can instantly review underwriting decisions to communicate competitive pricing to brokers and SMBs, while underwriters can access risk assessments without waiting for manual reviews. This streamlined approach not only speeds up operations but also minimizes errors caused by disjointed workflows. By fostering a fully collaborative environment, InsureComp empowers you to deliver faster, more accurate decisions that meet client expectations.

API

API integration with your existing workflow management, CRM, and other systems allows you to maintain your current prospecting journey without disruption, while leveraging the advanced features and functionality of our insurance technology, InsureComp.

Implementation Scenario

For instance, your sales teams can continue managing their prospective journeys in the CRM systems, while the API funnels data into InsureComp’s system for faster decision-making. Additionally, our API systems establish direct connections with carrier systems, enabling real-time data exchange and streamlining workflows across platforms. This flexibility means your teams can adopt InsureComp without steep learning curves or major operational overhauls. By ensuring a smooth and non-disruptive transition, the API feature enhances productivity, supporting long-term scalability for your organization.

OCR

OCR capabilities for both Loss Runs and Acord Applications expedite data extraction, analysis and decision-making, thereby eliminating manual effort.

Implementation Scenario

Imagine receiving a multi-page Loss Run or detailed application. With InsureComp’s OCR, this data is processed automatically and integrated into the platform within moments. Not only does this save your team hours of manual work, but it also reduces the risk of human error in data entry. Additionally, the faster processing times allow underwriters to evaluate risks more effectively, ensuring quicker responses to brokers and applicants. This feature enhances overall operational efficiency and contributes to delivering exceptional service in a competitive market.

Core Engine

The core engine has in-built algorithms for all 46 non-monopolistic states and is configurable for complex eligibility determination based on your programs’ appetite. This allows for quick fitment decisions for workers’ compensation programs.

Implementation Scenario

For example, if a submission comes through with unconventional risk factors, the engine evaluates and categorizes it based on predefined criteria, flagging it for approval or further review. By automating complex eligibility checks and risk assessments, the Core Engine enables your team to process more submissions in less time, paving the way for more profitable and sustainable underwriting practices.

Instant Indication

Instant Indication revolutionizes the quoting process by delivering real-time price indications for new submissions, enabling teams to respond quickly and close deals with unmatched speed. Powered by integrated rating engines and customizable pricing algorithms, this feature streamlines workflows and removes unnecessary delays.

Implementation Scenario

Imagine a growing company receiving a high volume of new business inquiries. Manual quoting slows down their response time and leads to missed opportunities. With Instant Indication, that wait is over. Teams get immediate pricing feedback—no back-and-forth, no guesswork. It’s the kind of instant response today’s clients expect that keeps them interested, helping you stay ahead, impress faster, and win more business in less time.

Get started today!

We’re here to help! Reach out to us anytime for assistance, inquiries, or just to say hello. Your questions matter to us